Easily Understand Your Finances

Realizing your dreams isn’t always easy. First Federal knows this and wants to help.

When it comes to achieving your goals—whether you’re hoping to buy a home, start a family, or plan for retirement—the sky is the limit… as long as you know your limits.

That's why we've put comprehensive views of your financial information right within your online banking session. You’ll have effortless access to information like spending habits, debt, and trends revealed within your First Federal accounts—and you’ll also be able to import other financial data, such as non-First Federal account balances. You’ll have everything you need within one simple view, so that you can see the complete picture of where your finances stand.

There are no extra apps to install or additional tools to learn—it’s all presented simply within your online banking session, making financial planning an effortless part of your daily experience, so that it’s simple to budget better for the things in life that matter most.

You’ll get quick, easy-to-understand views of:

- Budgets

- Spending

- Net Worth

- Debts

- Trends

To get started, just log into your First Federal Online Banking today!

{beginNavtabs}

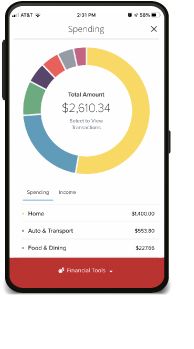

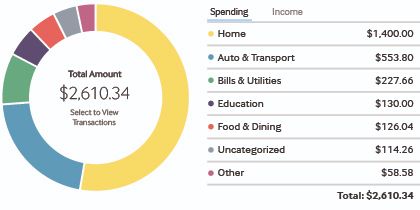

Spending

Displays your categories of spending for the time selected.

Budgets

There are two options for generating a budget: system-generated and user-created. The system-generated budget is based on your past few months of data. The more complete and accurate your categorization is, the more accurate your results will be.

Alternatively, you can manually create specific budget line items that you want to track.

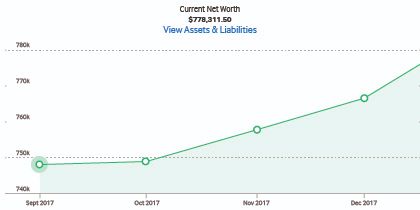

Net Worth

Display information from your accounts available, either accounts with First Federal or those you’ve added into your view from other institutions.

Trends

Provides an overview of spending trends over a period of time. This is especially useful if you are tracking a particular category of spending, such as eating out, and want a high-level view of your efforts.

Debts

See a list of all your debts in one central view. Modify your payment plan between popular payment strategies such as highest interest rate, lowest balance, and see the effect it could have on your timeline of being debt-free.

{endNavtabs}

{beginAccordion}

TIP #1

For a more complete picture of your finances, make sure to link your non-First Federal accounts!

Click on Link Account on your Online Banking Home Page, or within Financial Tools. Search for the account institution and provide your username and password.

TIP #2

You can hide accounts from your Financial Tools.

From the navigation Menu select Settings, Account Preferences, then select the account you would like hidden. Under the Account Visibility options, un-check Financial Tools. Repeat these steps for each account you want to hide.

TIP #3

Login to First Federal Online Banking and get started today!

If you aren't already enrolled in Online Banking: CLICK HERE

If you have any problems getting started, feel free to give us a call at 208-733-4222, and we'll be glad to help!

{endAccordion}